Miller

Handmade sunglasses with acetate arms.

Green gradient tint base 2 sun lenses with 100% UV protection and anti-reflective treatment.

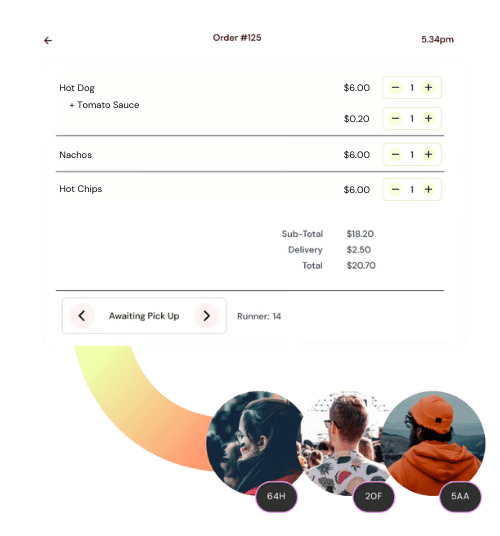

In-seat service is coming to a stadium near you. Get food and drinks delivered to your seat—we do all the running around, you just watch what you came to see.

We’ve got the cure for queuing.

No more lines—just enjoy what you came to see.

We’ll do the running around for you.

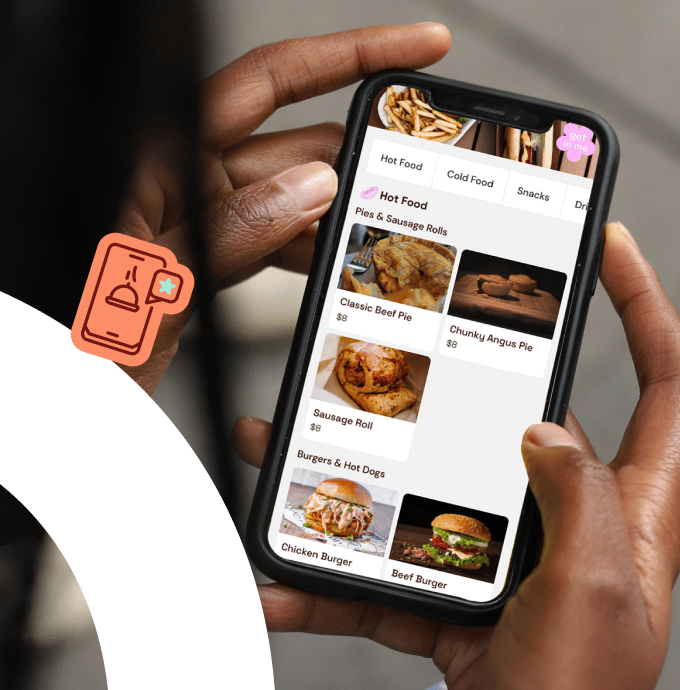

All your food and drink options at a glance.

Get treats to

your seats.

Reach thousands of customers right where they are.

With more access to customers and less pressure for all the orders to happen at once, Liively helps vendors increase their reach and capacity.

Patrons scan a QR code at the venue and enter their seat number.

1— SCAN

2— SELECT

Choose food, drinks and merch [coming soon] in the Liively web app.

We send those orders over to our vendors to prep and bag up.

3— SEND/PREP

4— DELIVER

We collect and deliver to the seat or a nearby collection point.

How does it work?

Representing a venue?

Get in touch with a member of the Liively team and we'll get you all the details.

PayTo Service Agreement

This is your PayTo Service Agreement with Liively Operations Pty Ltd. It explains what your obligations are if you ask us to establish a PayTo payment agreement. It also details what our obligations are to you.

Definitions

account means the account held at your financial institution from which we are authorised to arrange for payments to be made on your behalf.

account number means the BSB and account number for the account.

authorisation means your authorisation of the payment arrangement or amendment of the payment arrangement with your financial institution.

banking day means a day other than a Saturday or a Sunday or a public holiday listed throughout Australia.

Mandate Management Service means the secure database managed by NPP Australia Limited on behalf of our financial institution and if it supports PayTo services, your financial institution.

NPP Addressing Service means the database of account proxy identifiers maintained by NPP Australia Limited.

PayID means the identifier which you have registered in the NPP Addressing Service and which you provide to us as the identifier for your account. our financial institution means the institution which processes payments under the payment agreement for us.

payment agreement means the payment agreement between you and us which authorises us to arrange for payments to be made from your account.

payment day means the day that payment by you to us is due.

payment means a particular transaction where a payment is made from the account.

payment agreement creation request means your request to us to create the payment agreement on your behalf.

payment terms mean the value, cap and/or frequency of payments that you authorise us to arrange to be made under the payment agreement.

Service Agreement means the terms of this document. us or we means Liively Operations Pty Ltd, (the MPS User).

you means the customer who is authorised to operate the account.

your financial institution means the financial institution at which the account is held.

1. Establishing a Payment Agreement

1.1 By requesting us to establish a payment agreement, you have consented to us to using, disclosing and recording your details, including the account or PayID details you have provided to us, and the details of the payment agreement in the Mandate Management Service operated by NPP Australia Limited as a payment agreement creation request.

1.2 Not all financial institutions offer PayTo services. If your financial institution does not offer PayTo services, we will let you know and offer you an alternative payment option.

1.3 If your financial institution supports PayTo, your financial institution will retrieve the payment agreement creation request and deliver it to you, for you to view and to authorise at your discretion.

1.4 Your authorisation of the payment agreement creation request is required to be given to your financial institution in order for the payment agreement to be established. If your account is a joint account, your financial institution may need all joint account holders to authorise the payment agreement.

1.5 The method by which your financial institution communicates and delivers the payment agreement creation request to you is up to your financial institution.

2. Viewing the Payment Agreement

2.1 Your financial institution will provide you with a facility to view the payment agreements you have authorised.

2.2 You may also contact us to confirm details of your payment agreement with us via our customer support portal.

3. Payments under the Payment Agreement

3.1 As soon as a payment agreement is established, we may arrange for payment to be made from your account.

3.2 We will only arrange for payments to be made from your account in accordance with the payment agreement.

3.3 Before we arrange for any payment to be made, we or our financial institution will check the payment agreement in the Mandate Management Service to ensure it remains valid and active (that is, that it has not been suspended or cancelled, or otherwise amended, by you).

-----------------------------------

The PayTo service is a 24/7 service, which means the payment day may fall on a day which is not a banking day. If that is the case, we may arrange for payment to be made on that day. However, we may also choose to direct your financial institution to make the payment from your account on the first banking day after the payment day. If you are unsure about which day payments under the payment agreement will be made from your account, you should check with your financial institution.

4. Amendments by us

4.1 We may vary any details of this Service Agreement and any of our details included in the payment agreement at any time by giving you at least fourteen (14) days written notice.

4.2 If we wish to vary any payment terms of the payment agreement, where required we will submit these as requested amendments to the payment agreement in the Mandate Management Service. Your financial institution will notify you of the amendment and seek your authorisation (where required). This will be recorded in the Mandate Management Service for the amendment to take effect.

4.3 We may suspend or cancel the payment agreement at any time. If we do so, we will not be able to arrange for payments to be made from your account.

4.4 The status of our payment agreement with you will be as represented by the record of the payment agreement in the Mandate Management Service.

5. Amendments by you

5.1 You may change your account number or PayID in our payment agreement or suspend or cancel our payment agreement via your financial institution, which is required to act promptly on your instructions by modifying the record of the payment agreement in the Mandate Management Service.

6. Your obligations

6.1 It is your responsibility to ensure that there are sufficient clear funds available in your account to allow a payment to be made in accordance with the payment agreement.

6.2 If there are insufficient clear funds in your account to meet a payment:

- we may retry up to three times on the payment day to have the payment made

- you may be charged a fee and/or interest by your financial institution;

- you may also incur fees or charges imposed or incurred by us; and

- failing payment under a re-try being successful, you must arrange for the payment to be made by another method or arrange for sufficient clear funds to be in your account by an agreed time so that we can process the payment.

You should check your account statement to verify that the amounts debited from your account are correct.

7. Dispute

7.1 The record of the payment agreement in the Mandate Management Service is evidence of the value and frequency of payments that you have authorised us to have made from your account. If you believe that there has been an error relating to payments from your account, you may notify us directly on via our customer support portal so that we can resolve your claim quickly.

7.2 If we conclude as a result of our investigations that a payment has been made incorrectly from your account, we will respond to your query by arranging for your financial institution to adjust your account (including interest and charges) accordingly. We will also notify you in writing of the amount by which your account has been adjusted.

7.3 If we conclude as a result of our investigations that a payment has not been made incorrectly from your account, we will respond to your query by providing you with reasons and any evidence for this finding in writing.

7.4 As an alternative to contacting us in the first instance, you may contact your financial institution. Your financial institution will be able to review the payment agreement in the Mandate Management Service and the payment/s you believe have been made in error, and if appropriate recover the payment/s (plus interest and charges) from us.

8. Accounts

8.1 You should check:

with your financial institution whether PayTo is available from your account;

that your account details are in the correct format or the PayID which you have provided to us are correct; and with your financial institution if you have any queries about PayTo service.

9. Confidentiality

9.1 We will keep any information (including your account details or PayID details) in your payment agreement creation request confidential. We will make reasonable efforts to keep any such information that we have about you secure and to ensure that any of our employees or agents who have access to information about you do not make any unauthorised use, modification, reproduction or disclosure of that information.

9.2 We will only disclose information that we have about you:

to the extent specifically required by law; or

for the purposes of this service agreement (including disclosing information in connection with any query or claim).

10. Notice

Notices, if any, will be sent via email from payto@liive.ly

we are committed to protecting your privacy and ensuring the security of your personal information. This Privacy Policy explains how we collect, use, and disclose information when you use our services and interact with our website or mobile applications. By accessing or using our services, you agree to the terms and practices described in this policy.

Information We Collect:

We do not store or capture any personally identifiable information (PII) about you unless you voluntarily provide it to us. When using our services, we may collect non-personal information such as your IP address, device information, and browsing behavior for analytical and statistical purposes. This information does not identify you personally.

Transaction Processing:

We utilize Stripe, a trusted and secure third-party payment processor, for all transactions made on our platform. When you make a purchase or transaction through our services, Stripe collects and processes your payment information directly. We do not have access to or store your credit card or payment details.

User Authentication:

To ensure a seamless and secure authentication process, we leverage AWS (Amazon Web Services) for user authentication. This allows you to log in to our services using your Google or Apple account credentials, providing a convenient and trusted login experience. We do not store your Google or Apple login information.

Data Security:

We employ industry-standard security measures to protect your information from unauthorized access, alteration, disclosure, or destruction. However, please be aware that no method of transmission over the internet or electronic storage is 100% secure. While we strive to use commercially acceptable means to protect your information, we cannot guarantee absolute security.

Third-Party Websites and Services:

Our services may contain links to third-party websites or services that have their own privacy policies. We are not responsible for the practices employed by these third parties regarding the collection, use, and disclosure of your information. We recommend reviewing the privacy policies of these third parties before providing any personal information.

Children's Privacy:

Our services are not intended for individuals under the age of 13. We do not knowingly collect or store personal information from children under the age of 13. If you believe that we have inadvertently collected information from a child under 13, please contact us immediately, and we will promptly delete the information.

Changes to the Privacy Policy:

We reserve the right to modify or update this Privacy Policy at any time. Any changes will be effective immediately upon posting the revised policy on our website. We encourage you to review this policy periodically to stay informed about how we are protecting your information.

Be at great events and make some $.

Becoming a Runner for Liively means casual work where you can get amongst it (goodbye lock-down life), make money and choose your hours. Oh, and it's kind of a free work-out #takethestairs.

About Liively

Hi there, we're Liively and we're all about unlocking less waiting and more spectating! We know when you're trying to be in the moment that breaking out of it to take care of the mundane stuff (like lining up to get hydrated) really kills the mood. It's 2022 and we can do much better.

So we're here to change the game (or, well, let you see more of the game?) Needless to say, it's going to be a big year for us. Right now we're testing and perfecting our service at select locations in Victoria, so Melbournians keep your eyes peeled! You might see us at your next live event...

Customers Reviews

4.5 stars rated

Morbi amet morbi at praesent nisi etiam in. Venenatis, urna urna porttitor neque varius in. Luctus molestie nec, scelerisque risus. Arcu iaculis vel sem hac co

Lorem ipsum dollor sit amet

01/03/22

Lindsey Clarke

Morbi amet morbi at praesent nisi etiam in. Venenatis, urna urna porttitor neque varius in. Luctus molestie nec, scelerisque risus. Arcu iaculis vel sem hac co

Lorem ipsum dollor sit amet

01/03/22

Lindsey Clarke

Morbi amet morbi at praesent nisi etiam in. Venenatis, urna urna porttitor neque varius in. Luctus molestie nec, scelerisque risus. Arcu iaculis vel sem hac co

Lorem ipsum dollor sit amet

01/03/22

Lindsey Clarke

Morbi amet morbi at praesent nisi etiam in. Venenatis, urna urna porttitor neque varius in. Luctus molestie nec, scelerisque risus. Arcu iaculis vel sem hac co

Lorem ipsum dollor sit amet

01/03/22

Lindsey Clarke

Morbi amet morbi at praesent nisi etiam in. Venenatis, urna urna porttitor neque varius in. Luctus molestie nec, scelerisque risus. Arcu iaculis vel sem hac co

Lorem ipsum dollor sit amet

01/03/22

Lindsey Clarke

Morbi amet morbi at praesent nisi etiam in. Venenatis, urna urna porttitor neque varius in. Luctus molestie nec, scelerisque risus. Arcu iaculis vel sem hac co

Lorem ipsum dollor sit amet

01/03/22

Lindsey Clarke

Morbi amet morbi at praesent nisi etiam in. Venenatis, urna urna porttitor neque varius in. Luctus molestie nec, scelerisque risus. Arcu iaculis vel sem hac co

Lorem ipsum dollor sit amet

01/03/22

Lindsey Clarke